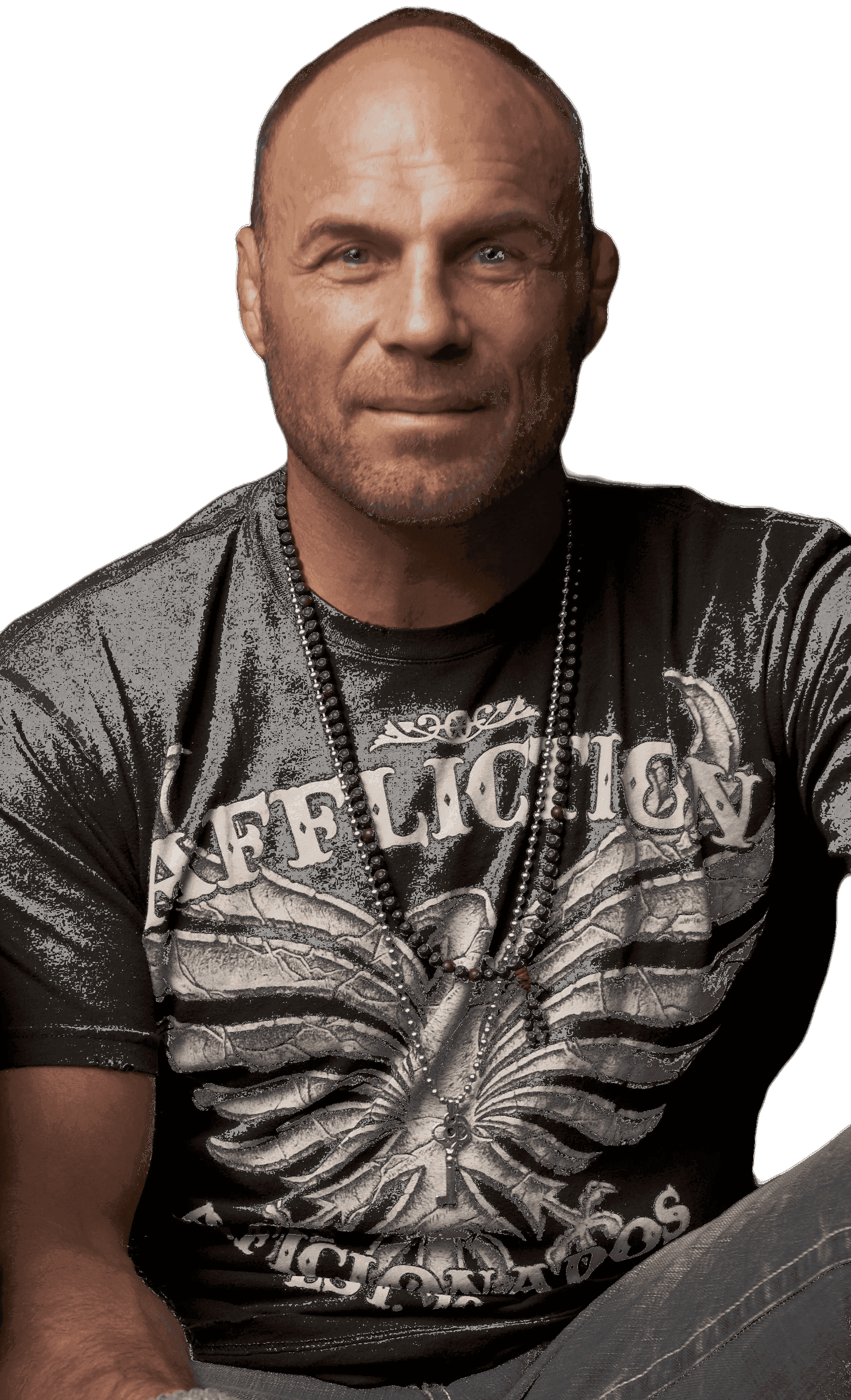

“If you are buying physical gold and silver, it pays to shop with trustworthy dealers and Metalsmart helps consumers do that.”

- Randy Couture

Blog

Bad Apples Spoil the Whole Bunch

Not all gold dealers are worth your trust

From Fox News to Newsmax and even on the radio, ads for retail gold and silver investments, promoted as a stable hedge against inflation and economic uncertainty, have sprung up everywhere. But for all the attention the precious metals market has gotten lately, it hasn’t all been good.

Reports have surfaced revealing that the retail precious metals industry is plagued by bad actors who take advantage of their clients’ trust to sell them precious metals products with exorbitant markups. Often, the dealers push ‘collectible’ products that are obscure and not very liquid, and the consumer has no easy way to understand the premium price and markup that they will pay before making their purchase. Product markups to consumers are often 33% or more. The price at which a dealer will buy back gold or silver can also help destroy returns. Consumers looking to sell their gold or silver collectibles often find out that the price they can sell at is at least 15% less than the price they would pay to purchase the same product.

There have been several lawsuits filed against precious metal dealers in the past five years as a result. For example, in January 2022, Lear Capital, which has since filed for bankruptcy, was ordered to pay $6 million for allegedly failing to disclose millions of dollars in commissions charged to investors in New York. In February 2022, Redrock Secured, LLC and its owner were sued by the California Department of Financial Protection and Innovation for perpetrating a $62 million fraudulent scheme that targeted elderly individuals.

In the Redrock case, the dealer marked up their product 100-130%. Those customers will never break even. It is pure greed. That’s a devastating loss for honest investors who are looking to stable, tangible precious metals to diversify their portfolios and protect against economic uncertainties.

Lawsuits don’t tell the whole story. Many consumers are unaware of the markups they pay, so they don’t file complaints. Thus, unscrupulous dealers go unpunished as precious metal buyers are unwittingly taken advantage of.

But the retail precious metals industry isn’t all bad. Gold, silver, platinum, and palladium are still valuable investments and there are honest dealers who charge their clients reasonable markups. And because precious metals are a big-ticket item, those dealers provide a valuable service. A buyer can spend $50,000-$1,000,000 or more on their metals portfolio and it’s important for people to be able to talk to a human and establish trust when investing personal savings. Gold dealers also can be very helpful if a customer wants to fund their purchase using a Gold IRA, which requires paperwork and expertise. The same could be said for real estate transactions, where buyers seek a trusted agent to advise and guide them through the process and paperwork before signing a contract. So how can precious metals consumers know who to trust?

One way that transparency can be increased is through an online platform that connect consumers and dealers in the precious metals industry. It’s the same concept as Lending Tree, the platform that allows potential borrowers to connect with multiple lenders to find the best terms for loans, credit cards, deposit accounts, insurance and more.

This is exactly what Metalsmart was created to do. Metalsmart allows for direct price comparisons and only allows vetted dealers on the platform. Consumers can save money and time while feeling confident that the dealers on the platform are committed to transparency and fair pricing. The potential is there to save retail customers billions of dollars annually and equip consumers with better control of their precious metals investment.

While there are many unscrupulous dealers, there are even more fair dealers who are operating above board to provide a valuable service. By increasing transparency and fairness, the industry can rid itself of avarice, reduce the number of unhappy and ripped-off customers, rid the industry of bad actors, and thrive in the next decade.

Get your free plan and save money on gold and silver today

Get your free plan and save money on gold and silver today